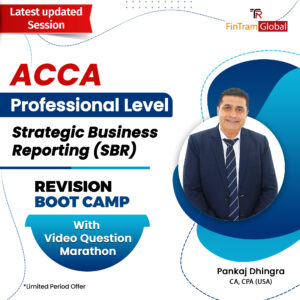

Product Description

| Faculty | Pankaj Dhingra |

|---|---|

| No Of Lectures | 39 Lectures of Approx. 1-1.5 hrs each. Its May vary based on the chapter |

| Validity Period | 6 Months or You passing the exam, whichever is earlier |

| Total Views | Unlimited |

| Mode | Google Drive |

| Runs On | Windows Desktop/Windows Laptop or Android Mobile except for Motorola Device |

| System Requirement | Windows: Window-8, Window-8.1, Window-10 and Window-11 Processor: Dual Core & Above Ram: 3GB & Above Check Display and Audio Drivers are Updated *Not Compatible with Window-7 and N-Editions of Windows-OS Androids: 7.0 – Android Versions & Above Minimum RAM 3GB Internal Storage 32 GB *Not Compatible with Motorola Devices |

| Video Language | English |

| Study Material | The PDF study material for download, save or print |

| Study Material Language | English |

| Applicable Exam | ACCA Diploma in IFRS |

| Applicable Course | ACCA Diploma in IFRS |

| Dispatched By | Fintram Global |

| Dispatch Time | Within 48 hours |

| Delivery Time | Within 48 hours |

| Amendments | YouTube |

ACCA Diploma in IFRS (DipIFR):

If you are a professional working in finance or accounting and you do not know IFRS, this ACCA Diploma in IFR course and qualification is an efficient and fast way to meet your needs. In your field, if you require knowledge of international standards, such as IFRS, then a diploma in IFRS can help you.

International Financial Reporting Standards (IFRS) are taught in more than 100 countries worldwide. Hence, it has become very important for individuals to know and understand these standards.

Countries worldwide have adopted IFRS or equivalents as their local Generally Accepted Accounting Principles (GAAP). And many other countries around the world, including India, are moving towards applying IFRS, which is having a very significant impact on financial reporting.

This course is designed to develop your understanding and knowledge of International Financial Reporting Standards.

ACCA Diploma in IFRS Syllabus:

- International sources of authority

- Elements of financial statements

- Presentation of financial statements and additional disclosures

- Preparation of external financial reports for combined entities, associates and joint arrangements

ACCA Diploma in IFRS fees

The ACCA Diploma in IFRS (DipIFR) equips you with the essential knowledge and skills to navigate the world of IFRS standards. The IFRS Diploma fees typically covers the cost of the study materials, examination fees, and registration charges. It may also include access to online resources, and tutor support. But before you embark on this enriching journey, let’s address a crucial aspect: ACCA Diploma in IFRS fees.

Initial registration is £89 and ACCA Diploma in IFRS Exam fees are £143. Please reach out to FinTram to get the scholarship program for the ACCA Dip IFR Course.